How does workers' comp work in Florida?

Workers compensation in Florida continues to stabilize as the cost of workers compensation has improved over the past few years. Just last year, NCCI recommended a rate reduction of over 5% on average.

The largest threat to Florida insurance industry has come from some contractors who have utilized illegal employee leasing schemes and shell companies to get around the laws in Florida. The Florida Department of Workers Compensation has stepped up enforcement and continue to levy large fines or cease operations of those companies evading the proper system. Florida has one of the highest rates of insurance fraud in the U.S.

Give us a call at 888-611-7467 if we can provide any help with your workers' comp coverage.

Workers' Comp Rules & Information for Florida

Workers' Comp Regulations in Florida

Florida Department of Financial Services

200 E. Gaines Street

Tallahassee, FL 32399

800-342-2762

The Florida Division of Workers’ Compensation is responsible for enforcing employer compliance with the coverage requirements of the workers’ compensation law. Compliance investigators have the authority to enter and inspect any place of business for purposes of ensuring employer compliance with workers’ compensation law. Investigators can also request an employer’s business records. An employer must produce the required business records within ten business days of receiving the Division’s written request for records.

Florida Rates on the Decline

The Florida Office of Insurance Regulation voted to lower Workers' Compensation Insurance Rates by 5.1%.

A report done by the Office of Insurance Regulation mentioned rates in Florida are down since 2012. Florida underwent a major overhaul of the Workers' Comp System several years prior. In this same report the Office recommended the changes made in the 2000's have probably impacted rates as much as they can and business owners should expect rates in the state to remain constant.

Florida Regulators Order Cut in Work Comp Rates.

Florida Farmers and Government Employees

Farmers in Florida are required to buy workers' comp coverage if they have more than 5 regular employees and/or 12 or more other workers for seasonal labor for 30 days or more.

All state and local governments in the state of Florida are required by law to carry workers compensation for employees regardless of the number of employees.

Florida State Fund and JUA

There is not a state fund in Florida. However, Assigned Risk coverage in Florida is provided by the Florida Workers' Compensation Joint Underwriting Association (FWCJUA.) The JUA was created to provide workers' compensation insurance to employers who are unable to purchase coverage through the voluntary market.

Florida and NCCI

Florida is an NCCI state and the National Council on Compensation Insurance is headquartered in Boca Raton, Fl. NCCI advises the Florida State Rating Bureau on rate filing for class codes and also manages statistical data for the state. NCCI also determines and notifies employers regarding their experience modification rate on an annual basis.

Non-Compliance Violations in Florida

The Division of Workers' Compensation enforces employer compliance in Florida. Investigators conduct inspections and may issue a Stop-Work Order, ceasing all business operations if the employer lacks the required Florida workers' compensation coverage. The Division will assess a penalty equal to 2 times the amount the employer would have paid in manual premium within the preceding two year period.

A Stop-Work Order may also be issued if an employer understates or conceals payroll, misrepresents or conceals employee duties or otherwise attempts to avoid paying workers' compensation premiums. Such actions could also result in criminal charges and penalties.

Florida First Report of Injury

As soon as you become aware of a work-related injury or illness, immediately contact your workers’ compensation insurance carrier. If you do not report the injury or illness to your insurance carrier within seven days of the date you were informed, you may be subject to an administrative fine not to exceed $2,000 per occurrence. Most insurance companies have a toll-free number to report work-related injuries. If you report the injury or illness to the insurance carrier by telephone, the carrier will complete the form and send a copy to you and the employee within three business days. You can also fill out the First Report of Injury or Illness form (DWC-1) and send it to the insurance carrier.

Florida Insurance Directives Regarding Covid-19

When prudently possible, insurers are “encouraged” to be flexible with premium payments to avoid lapse in coverage, including: 1) relax due dates; 2) extend grace or reinstatement period; 3) waive late fees and penalties; and 4) allow payment plans. Insurers encouraged to only consider cancellation if other options exhausted. Insurers should message consumers and agents the avenues by which they can communicate specific circumstances to insurer.

Discretionary order in effect from 03/25/2020 - further notice.

State Orders Regarding Insurance Claims Related to Coronavirus

FL reminds WC insurers that first responders, health care workers, and others that contract COVID-19 due to work-related exposure would be eligible for workers’ compensation benefits under Florida law.

Mandatory order in effect from 04/06/2020 until further notice.

Specialized Programs for Select Industries

We work with our national insurance partners to develop targeted programs with easier underwriting requirements and lower rates. We offer a broad range of business class codes that help streamline the quote process so you get the lowest price for coverage.

How Does Workers' Compensation Work?

- What is Workers' Compensation?

- How Much is Workers Comp?

- Experience Modifiers & EMR Ratings

- Workers' Comp Class Codes

- 1099 vs W-2 Employee

- Workers Compensation Basics

- Employers Liability Insurance

- Workers' Compensation FAQ's

- Multi-State Insurance

- Workers' Compensation Laws

- State Insurance Fund

- Workers' Comp Claims

- Workers Compensation Benefits

- Managing Workers Comp Audits

- Workers' Comp Exemptions

- Ghost Policy

Florida requires that workers compensation insurance be purchased from licensed insurance agents authorized to sell insurance in the state. Workers Compensation Shop.com is licensed in the State of Florida, with access to more workers compensation companies than most other state and regional agencies.

Let Workers Compensation Shop.com help your business navigate workers' comp insurance in Florida.

From ownership rules, class code reviews, to managing audits & claims, we've got your business covered.

Our technology matches your business with insurance companies most likely to offer the best deals.

We leverage our experience and relationships to negotiate your lowest workers' comp rates.

No carrier quotes every class code. That's why we've built a diverse group of great insurance companies.

Workers' Comp Includes Employers Liability Insurance?

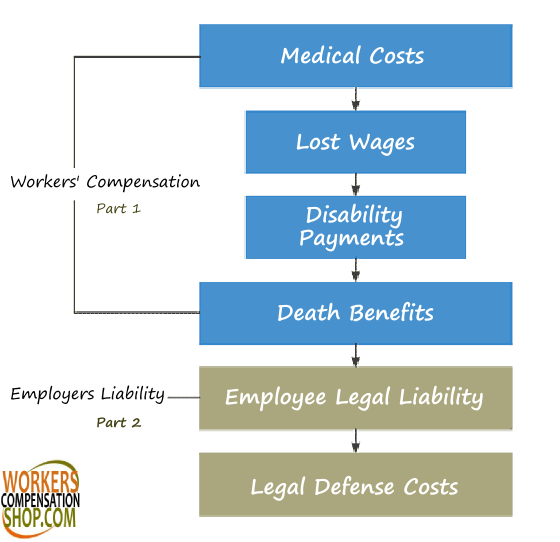

Employers liability insurance is an additional layer of coverage included as part of a workers' compensation insurance policy. Employers Liability is known as Part 2 of the policy. It adds two additional coverages for employers:

Employers Legal Liability and Legal Defense Costs

In today's world, there are a variety of reasons employees and third-parties sue employers for damages. Here a some common types covered by employers liability insurance:

Third Party Lawsuits

Your employee sues another party that may have contributed to the injury, In turn, the third party sues your business.

Consequential Bodily Injury

Another party or individual is injured while providing care for the injured employee.

Dual Capacity Legal Action

An employee files a claim but also attempts to sue the employer for being responsible in other ways outside of the employment relationship.

Loss of Consortium

A spouse sues for damages caused by the loss of companionship or relations.

Employers Liability coverage is not included with coverage in the four monopolistic states. Employers in these states can endorse this coverage onto their General Liability policy. That coverage is commonly known as Stop Gap Coverage.

- Employers liability coverage is not included in all monopolistic states.

- All NCCI and most other states' coverage includes employers liability insurance.

California DBA: I-Shop Online Insurance Agency.